Days

Hours

Minutes

Seconds

Days

Hours

Minutes

Seconds

Register and become part

of the global financial exhibition

Register and become part

of the global financial exhibition

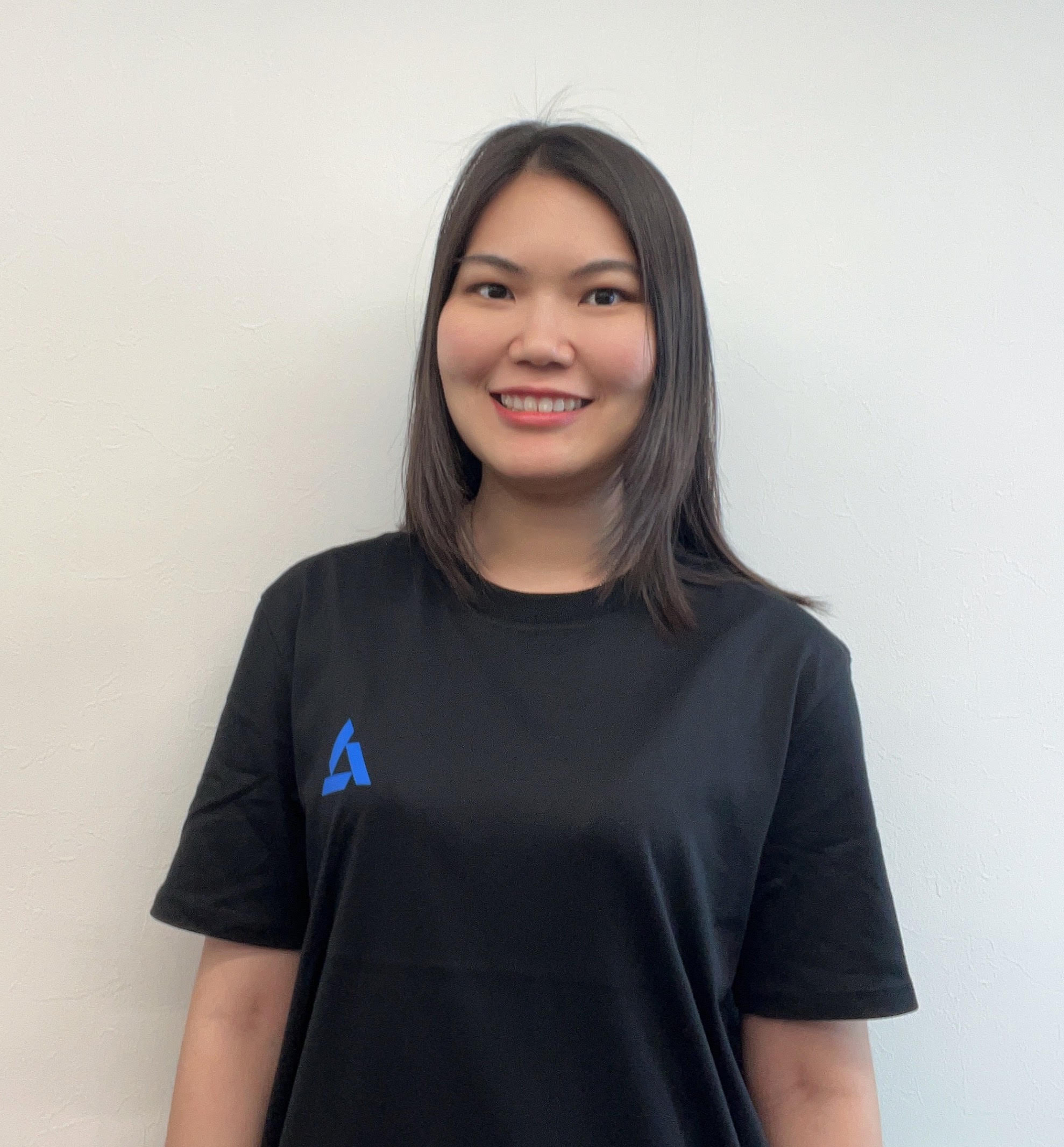

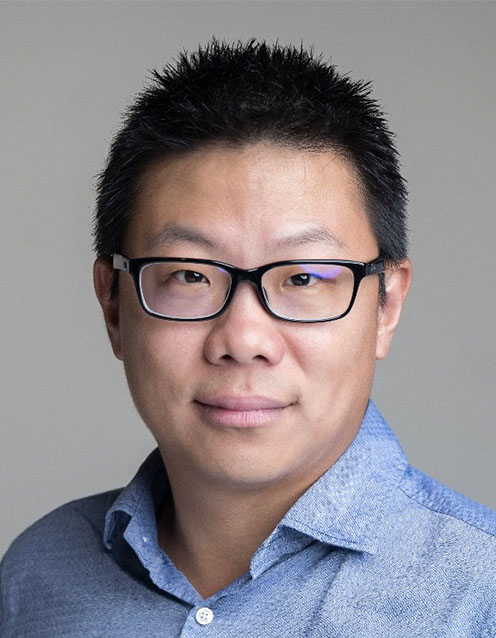

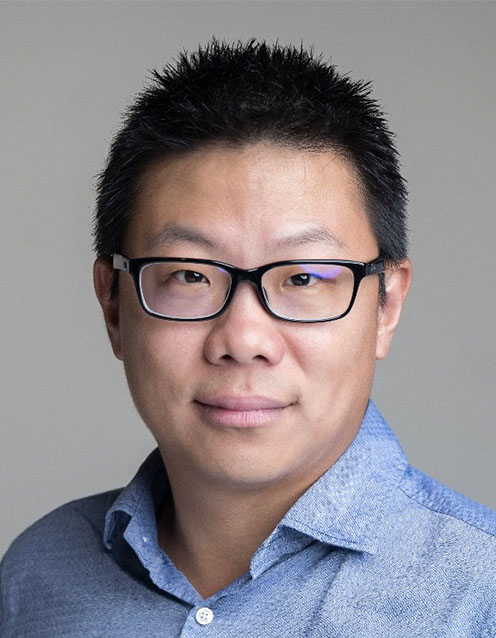

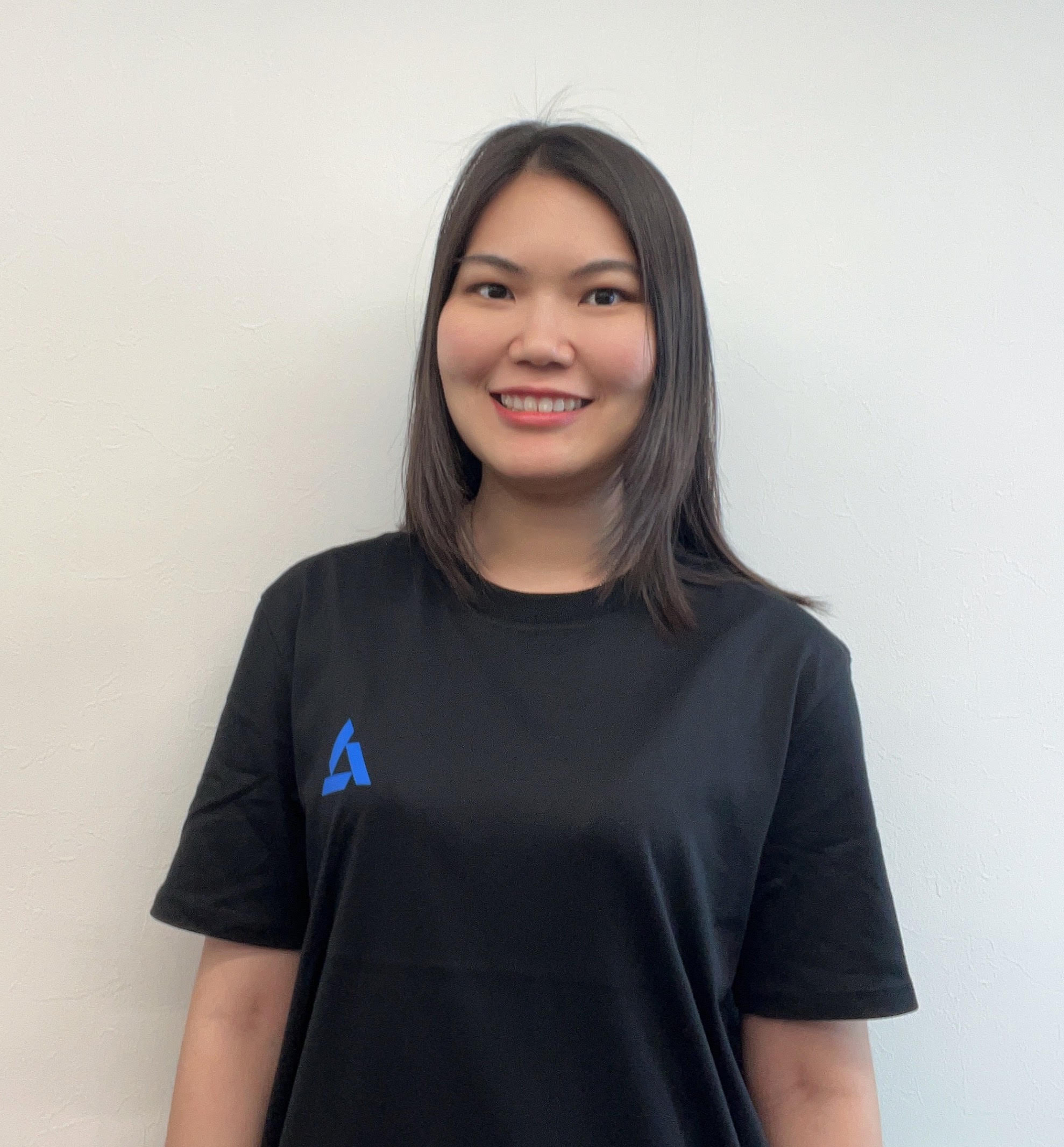

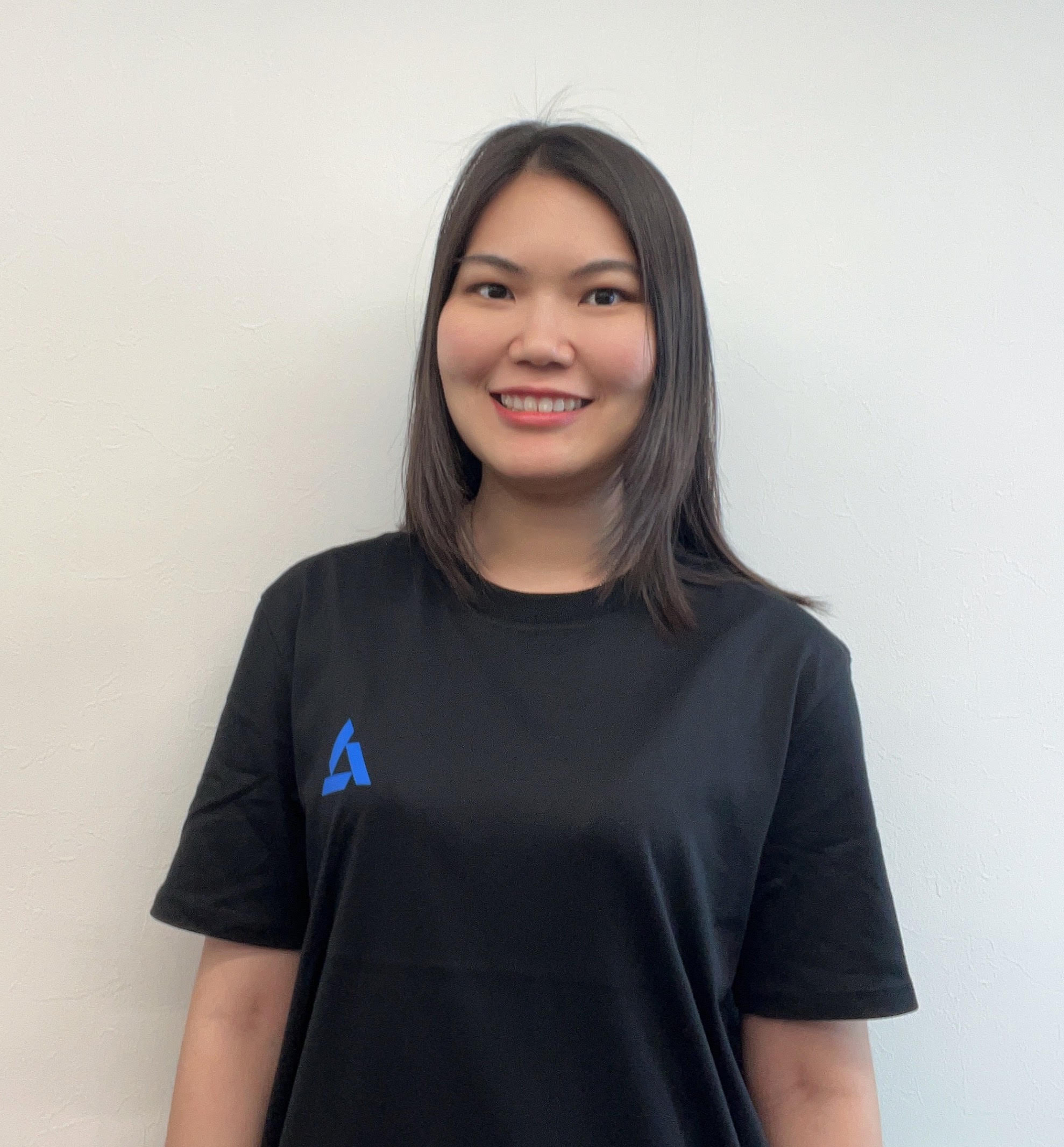

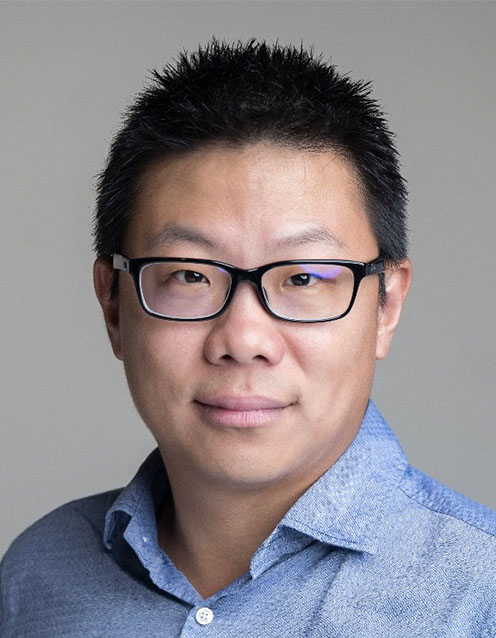

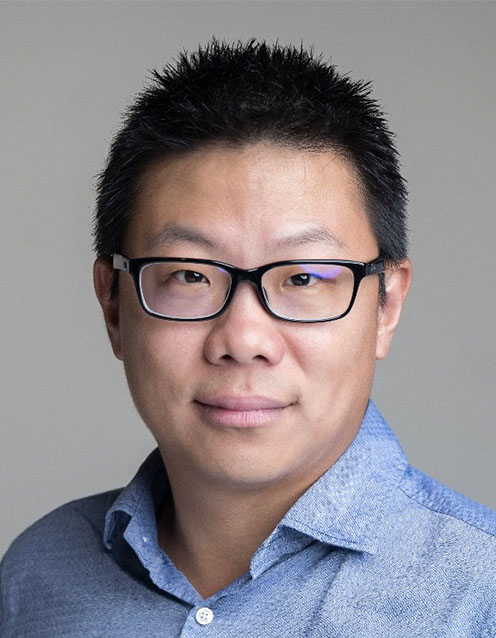

Listen to engaging content from inspiring industry experts. There will be important updates and hot topics up for discussion. World-class speakers that have taken the iFX EXPO stage:

Saxo Bank

Invest Cyprus

Swissquote Bank

Funnel Cross

Chamber of Digital Commerce

Trading Central

CryptoUK

Outbrain

Cyprus Securities & Exchange Commission

Exness

HR Cyprus HR Management Association / Hellenic Bank

Nuvei

Fxview

MetaQuotes

NAGA Markets

PwC Cyprus

Finalto

Intercash